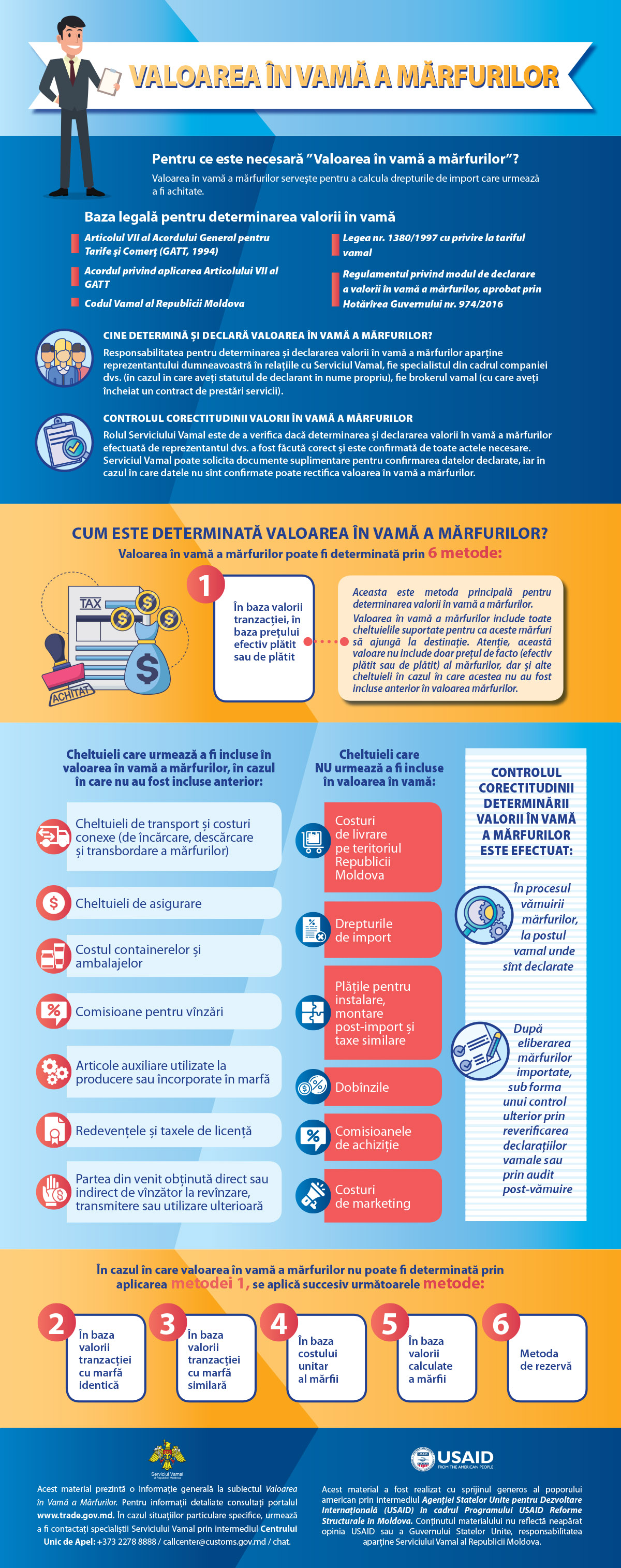

The customs value of goods serves as a basis for calculating ad valorem import duties, while the declarant is responsible for declaring the customs value of goods and its elements.

I. Method of determining the customs value of the goods based on the transaction value, respectively based on the actual price paid or payable (method 1)

The primary basis for the customs value of goods is the transaction value, i.e. the actual price paid or payable for imported goods (method 1 – based on the transaction value), adjusted, if applicable.

a) Expenses to be included in the customs value

The following costs are added to the transaction value if they have not already been included in the price.

Transport and related costs:

- costs of transportation to the place of entry (road or railway, the airport or the port of unloading);

- any charges related to loading, unloading and handling associated with the transport of goods;

- insurance costs.

Containers and packages: payments to be made by the importer for the use and return of the package or container are included in the customs value, except when they are placed in temporary admission.

Fees: any brokerage fees, paid to reward the seller's agent or a third party for services relating to the sale of goods.

Auxiliary items delivered by the buyer and required for the production and sale of imported goods (e.g. parts, materials or special production tools or dies).

Means obtained from resale: income from resale, transmission or subsequent use of goods in the Republic of Moldova, gained, directly or indirectly, by the seller.

Royalties and licensing fees: payments made by the buyer to the seller or a third party for certain intellectual property rights to use goods (e.g. patents, trademarks, copyrights).

Note: All the elements to be added should be based on objective and quantifiable data; at the same time, other elements not covered by the legal framework may not be added.

b) Requirements for declaring of the customs value

Method 1 is usually applicable to sale and purchase transactions. The actually paid or payable price is the total amount of payments made or to be made by the buyer to or for the benefit of the seller for the imported goods and includes all payments made or to be made as a condition for the sale of imported goods by the buyer to the seller or by the buyer to a third party to fulfil a seller's obligation. The payment can be made as a transfer of funds by either a letter of credit or a negotiable instrument, and can be made directly or indirectly.

When applying method 1, the price with trade discount may also be accepted if it refers to the goods to be valued, and upon acceptance of the customs declaration, the commercial documents relating to the transaction stipulate the application, the conditions and the amount of such discount.

At the same time, the transaction value is not applicable in the case of free deliveries (gifts, samples, promotional items); goods brought into the country on consignment; goods imported by branches that do not have legal personality; goods brought into the country under a rent or leases contract; goods which are the subject of a loan but which remain the property of the supplier.

The customs value is determined in the national currency, the Moldovan leu. Thus, the amount in another currency should be converted using the official exchange rate established by the National Bank of Moldova on the day of the customs obligation.

c) Documents required to declare the customs value

When announcing the customs value, the declarant shall fill in the D.V.1 customs value declaration form, which is filed together with the customs declaration.

D.V.1 shall not be used in the following cases:

- when the value of goods is less than or equal to 5,000 euros;

- in the case of customs treatments exempted from payment of import duties;

- if the declarant is an AEO.

At the request of the customs authority, the declarant shall submit, in addition to the documents already submitted for customs clearance (the minimum set of documents required for customs clearance includes an invoice, a transport document and, where applicable, a permissive document), additional documents, depending on the specificity of the transaction, certifying the stated value, such as:

- the contract and addenda, if any;

- payment documents in case of prepayment;

- the contract (order) for the provision of transport services or the bill of consignment, according to the delivery conditions;

- the goods insurance policy or contract, if they were insured either according to the delivery conditions or at the declarant's initiative.

In addition, if the customs authority finds proven divergences between the data in the mentioned documents, identifies a risk of undervaluation of goods, they shall request in writing the submission of other documents relating to the import transaction (e.g.: contracts with third parties regarding indirect transactions; commercial correspondence; producers'/sellers' price catalogues, price offers (price lists) etc.).

Note: In cases when customs authority, during customs control, does not accept the declared value in line with method 1, other methods of customs valuation are applied consecutively or a release of goods under guarantee is requested.

II. Release of goods under guarantee (postponing the determination of the customs value)

If the customs value cannot be finally determined in the customs clearance process, the goods may be released to the declarant, provided that a guarantee is lodged in the form of a cash deposit, a bank guarantee or a customs broker guarantee (as preferred by the declarant). The amount of the guarantee is the difference between the import duties calculated on the basis of the customs value determined by the customs authority and those calculated by the declarant.

The declarant may submit additional documents to confirm the customs value within 30 days, and if the declared customs value is accepted, the guarantee shall be refunded. If such documents are not accepted by the customs authority, the import duties shall be collected from the guarantee.

If the declarant does not present in time the additional information or the presented documents do not confirm the veracity of the declared value, the customs authority shall independently determine the customs value of goods, by applying the stipulated methods consecutively.

In that situation, the declarant is obliged to amend the customs declaration and to pay the import duties recalculated from the customs value determined by the customs authority. The decision of the customs authority may be challenged within 10 days before the customs authority and, subsequently, in the court.

III. Other methods of customs valuation

If the first method of customs valuation cannot be applied, other valuation methods shall be applied successively, as follows:

- Based on the value of transaction with identical goods (2nd method) – goods that are similar in all respects with goods being valued, including their physical characteristics, the quality of goods and their market reputation, the country of origin, the manufacturer.

- Based on the value of a transaction with similar goods (3rd method) – goods that, although not identical, have similar characteristics and consist of similar components, which allows them to perform the same functions as goods being valued and to be commercially interchangeable. When determining the similarity of goods, the following characteristics are taken into account: quality, availability of a trademark, market reputation, country of origin, manufacturer.

Those two methods shall be applied when identical or similar goods:

- are sold to be imported in the Republic of Moldova;

- are imported at the same time or no later than 90 days before the importation of goods to be valued;

- are imported approximately in the same quantity and/or under the same commercial conditions.

If the identical or similar goods were imported in a different quantity and/or under different commercial conditions, the customs value shall be corrected, taking into account such differences.

If, when determining the customs value of goods, the value of one of several transactions with identical or similar goods may be taken as the basis, the lowest value of transaction shall be used.

- Based on the unit cost of goods (4th method). In that case, the customs value will be based on the unit price for the sale of such goods or the sale of identical or similar goods in the largest total quantity, concurrently or almost concurrently with the import of goods to be valued to persons who are not related to the seller and provided the deduction, as follows:

- commissions paid ordinarily or agreed, or of the margin, usually applied to profits and general expenses related to the sale of goods of the same class or of the same type;

- ordinary transport and insurance expenses, as well as related expenses incurred on the territory of the Republic of Moldova;

- taxes and duties liable to be paid in connection with the importation or sale of goods.

- Based on the computed value of goods (5th method), which includes

- the value or price of materials and manufacturing operations or other works for the production of goods;

- the amount of profit and general expenses, equal to that usually included in the amount of sales of goods of the same class or type with goods to be valued, manufactured by producers for import into the country of import;

- any other expenses for the transport of goods to the place of entry of goods into the customs territory.

- Fall-back method (6th method) – the customs value is determined based on the available data.

At the same time, the following cannot be taken as a basis:

- the selling price in Moldova of goods produced in the territory of the Republic of Moldova;

- the price of goods on the domestic market of the country of exportation;

- arbitrary or fictitious values of goods;

- a system which provides for the acceptance for customs purposes of the higher of two alternative values;

- the cost of production of goods, other than computed values of identical or similar goods, determined according to the price of materials and manufacturing operations or other works for the production of goods;

- the price of the goods for export to a country other than the country of importation;

- the minimum customs value of goods.

Legislation:

Customs Code of the Republic of Moldova no. 1149 / 20/07/2000

Law no. 1380 of 20/11/1997 on customs tariff