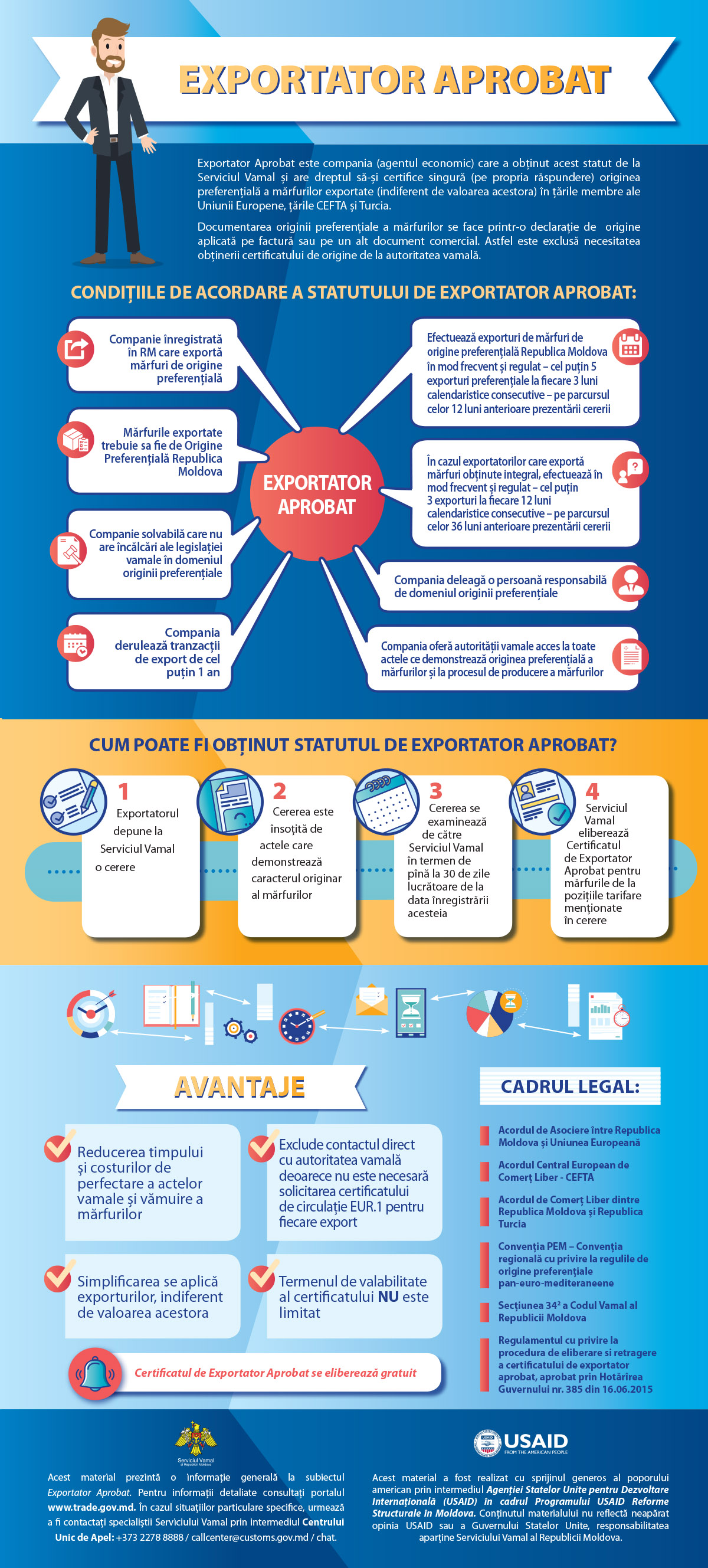

The Approved Exporter status is applicable to the trade with EU and CEFTA member states and Turkey under the Regional Convention on pan-Euro-Mediterranean preferential rules of origin and aims at simplifying the procedure for certification of the origin of exported goods.

The Approved Exporter is entitled to document the origin of goods on their own responsibility by filling in a declaration of origin on the invoice, without the need to obtain the EUR1 certificate, regardless of the export value. Thus, the Approved Exporter has several advantages, including faster customs clearance, minimized costs and simplified export formalities.

The Approved Exporter status may be granted to companies that meet certain predefined requirements, as follows:

- performed export operations for at least 1 year;

- have a positive record of compliance with the customs legislation and have not committed any violation of the customs legislation over the last 12 months;

- have a preferential export history of at least one year. At the same time, a certain frequency and regularity of preferential export operations is required (at least 5 exports every 3 consecutive months over the last 12 months prior to the submission of the application, and for the wholly obtained goods, 3 exports within 12 months over the last 36 months of activity);

- comply with the preferential origin rules and ensure access of the customs authority to all documents proving the origin of goods (including accounting documents, IT system for registration of customs operations and production process);

- the company appointed a person responsible and competent in the field of origin of goods.

I. Documents required to obtain the status

The approved exporter certificate is issued upon submission of an application (.docx, .pdf) by the economic operator, by filling in a special form, and attaching documents confirming compliance with the conditions for obtaining the respective status, as follows:

- incorporation documents of the economic operator applying for such status;

- contracts under which exports of originating products will be made, if available;

- description of the workflow for obtaining the finished products for export;

- proofs of origin that accompanied the components and materials upon their importation or placement under a customs suspensive arrangement, if such components or materials were used to obtain the exported goods;

- documents accompanying the finished products upon their previous exportation or placement under a customs suspensive arrangement;

- documents certifying that, for non-originating materials used in the manufacture of goods, the customs duties were not refunded and that all customs duties or charges having equivalent effect applicable to the respective materials were actually paid: customs declarations, invoices, etc., if the exported originating goods are obtained under the inward processing procedure or in the free economic zone;

- appropriate evidence of the working or processing undergone outside the Republic of Moldova, if such working or processing took place;

- other documents supporting statements made in the application.

The Customs Service shall review the application and the attached documents within 30 working days from the date of its registration and may control the applicant's activity.

The Approved Exporter certificate is issued free of charge for an unlimited period.

The Customs Service shall monitor the use of the certificate and, based on risk analysis, may order the subsequent verification of the exporter.

If the Approved Exporter does not fulfil its obligations, the Customs Service shall withdraw its status.

The Approved Exporter certificate may be withdrawn in case of amendment of the legislation or upon the written request of the holder.

II. Obligations of an Approved Exporter

The Approved Exporter is obliged to:

- ensure the completion of the declaration of origin only for goods that meet the rules of preferential origin;

- ensure the keeping of a copy of the document on which the declaration of origin is made and copies of documents confirming the preferential origin of exported goods covered by the declaration of origin, for a period of at least 4 years from the date of issue;

- submit, by the 10th day of the month following the reporting month, the report (.docx, .pdf) on documents on which the declarations of origin were made, according to the model;

- inform the Customs Service about the change of name, legal address, goods production process and export contractual relations established under preferential treatment, within 10 working days from the day of change;

- ensure, whenever requested by the Customs Service, all the conditions required to control the production activity, in order to confirm the production capacities and the correct determination of the preferential origin of exported goods.

III. Draw up a declaration of origin

When performing customs operations, the exporter shall specify in the invoice or in another commercial document the exact text of the declaration of origin, according to the prescribed model.

The declaration shall be entered on the invoice or other commercial document describing the exported goods in sufficient detail to allow their identification, and shall include the number of the certificate.

The text of the declaration shall correspond to the model made out in one of the language versions.

Romanian version:

„Exportatorul produselor ce fac obiectul acestui document (se menționează numărul certificatului de exportator aprobat) declară că, exceptînd cazul în care în mod expres este indicat altfel, aceste produse sînt de origine preferenţială (se menționează țara de origine).

(Locul şi data), (Semnătura exportatorului, numele persoanei care semnează declaraţia)”.

Legislation:

Section 342, Customs Code of the Republic of Moldova no. 1149 of 20/07/2000

Law no. 1380/20/11/1997 on the customs tariff

Government Decision no. 385/16/06/2015 on the implementation of provisions of section 342