The Local Clearance Procedure (LCP) allows faster customs clearance of goods at lower costs. of low-cost goods. Customs clearance is performed remotely, using the electronic procedure with electronic signature, and customs formalities are carried out moving to goods to the internal customs post. Thus, the goods are loaded, in case of export, or unloaded, in case of import, directly at the headquarters of the economic operator (in the warehouse or in another authorized space). Where selected for inspection, the customs officer shall travel to the place where the goods are located.

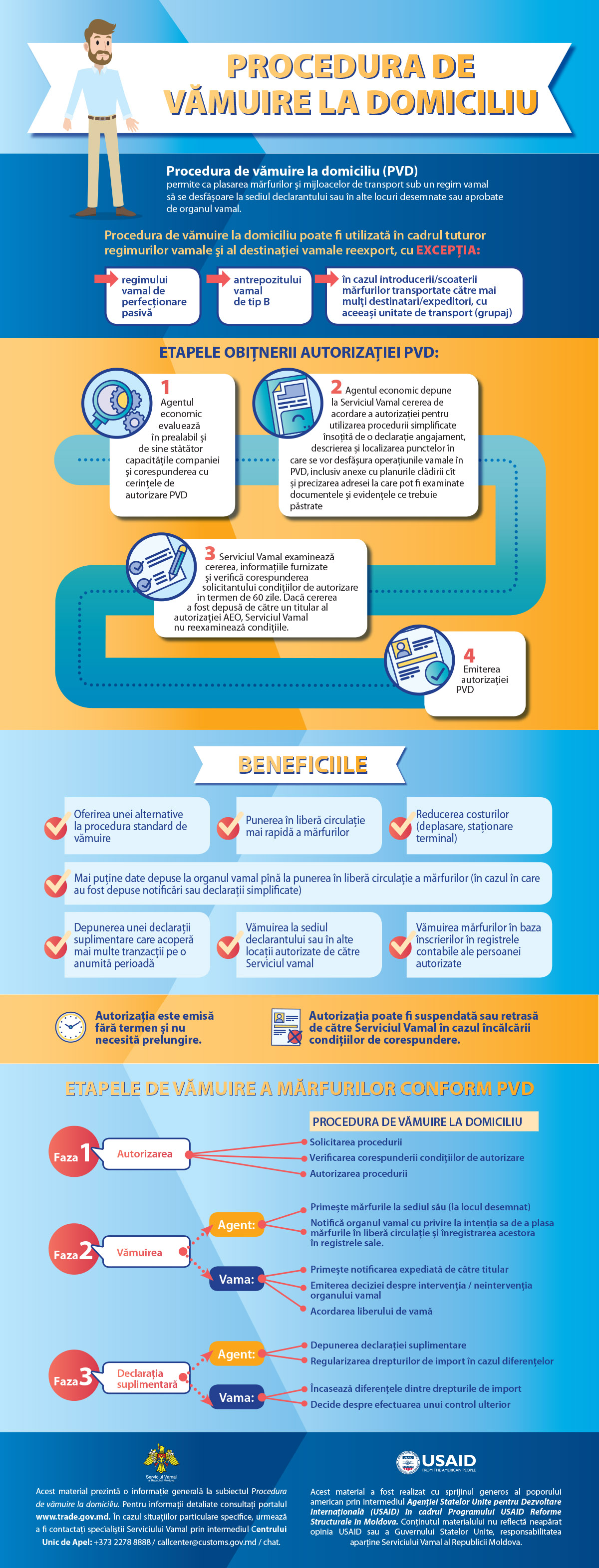

Local clearance is applicable to all customs procedures and customs re-export destination (except for the outward processing customs procedure, type B customs warehouse – public warehouse, as well as introduction / removal of goods transported by several consignees / shippers with the same transport unit (grouped consignment).

The local clearance procedure at import includes the following stages:

- presentation of the goods at the location authorized by the Customs Service and conclusion of the transit operation;

- completion, storage and registration of the electronic customs declaration;

- control of the electronic customs declaration;

- granting customs clearance and unloading of goods.

The procedure shall apply accordingly to other customs procedures, as well.

I. Requirements towards LCP applicants

To benefit from local clearance procedure, the economic operator must meet the following conditions:

- lack of repeated violations of the customs and tax legislation. The requirement is deemed to be observed where, during the last three years before the application is lodged, the applicant, the person authorized to represent the applicant or to exercise control over the applicant’s management, the officer in charge for the customs issues of the applicant has not committed repeated violations of the customs and tax legislation and has not been engaged in serious infringements related to the economic activity thereof. Minor infringements do not constitute an impediment if such infringements are of little importance in relation to the number or extent of customs operations and do not give rise to suspicion as to the good faith of the applicant;

- existence and operation of a commercial and transport records management system, to allow adequate performance of customs controls. In this regard, consideration shall be taken of as follows: application of an accounting system in accordance with general requirements; ensuring customs access to records and registers; existence of a logistics system to ensure separate management conditions for foreign and domestic goods and to indicate, where appropriate, the location thereof; the use of an internal control system capable of identifying illegal or irregular transactions; training of in-house officers in charge for customs ussies on customs notification procedures in event of irregularities; protection of the IT system against interference; disposal, where appropriate, of satisfactory procedures for the management of import and/or export licenses and/or authorizations granted in accordance with economic policy measures;

- existence of practical standards of competence or professional qualifications directly related to the activity carried out. The requirement is deemed to be observed where any of the conditions below are met:

a) the applicant or the officer in charge for customs issues of the applicant holds a proven practical experience of at least three years in the customs field;

b) the applicant or the officer in charge for customs issues of the applicant has completed a training course in the field of customs legislation.

II. LCP authorization

The authorization for the use of the Local Clearance Procedure shall be issued at the request of the economic operator through lodging of a standard application (.docx, .pdf), to which the declaration-commitment (.docx, .pdf) and the following documents shall be attached:

- description and location of the points where the customs operations shall be carried out under the local clearance procedure, including annexes with the building plans;

- specification of the address where the documents and records to be kept in accordance with the customs regulations may be examined.

The Customs Service shall, within a maximum of 10 calendar days, verify the information submitted and inform the economic operator on the acceptance of the application.

Where found that the application does not contain all the information required, the Customs Service shall request the applicant to provide the relevant information within a time limit not exceeding 30 calendar days from the date of receipt of the application.

The application and the attached documents shall be examined within up to 60 calendar days from the date of acceptance of the application. The authorization shall be issued for an unlimited period.

In the event of non-compliance with the conditions of the authorization, the authorization may be suspended or withdrawn.

Procedura de vămuire la domiciliu (PVD).pdf

Legislation: